- Number of total and primary customers increases by more than 250,000 each

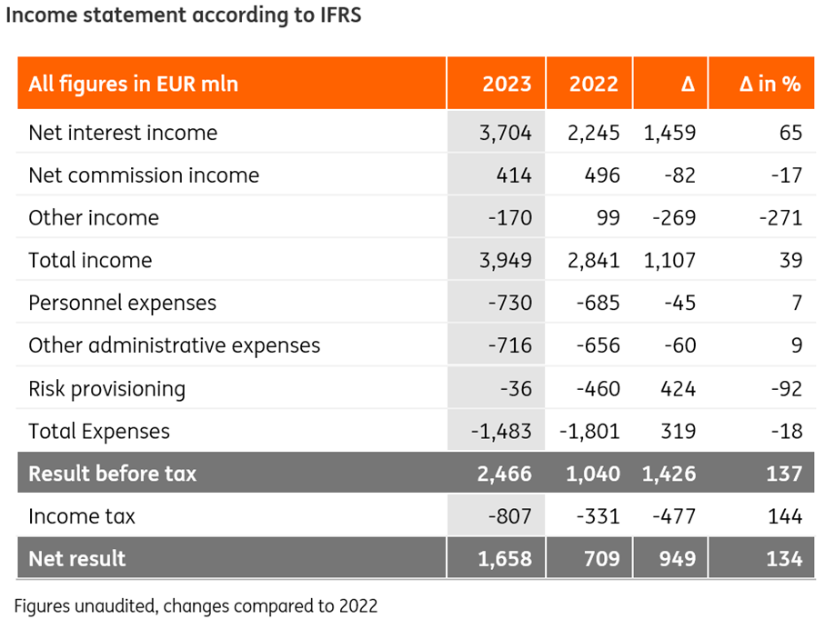

- Earnings before tax more than doubled: EUR 2.47 billion (2022: EUR 1.04 billion)

- Retail deposits increase by EUR 8.5 billion

- Credit volume grows in Retail, Business and Wholesale Banking

Frankfurt am Main, February 1, 2024 – ING Germany closed the 2023 fiscal year with record results and increased the number of customers quantitatively and qualitatively. The bank achieved EUR 2.47 billion earnings before tax. A key driver was the significantly improved interest income, which rose to EUR 3.70 billion (2022: EUR 2.25 billion).

The number of customers grew by over 250,000 net to just under 9.4 million (2022: 9.1 million). The number of primary customers, who use the current account with a monthly cash receipt and at least one other product, also increased by over 250,000 net to just under 2.7 million (2022: 2.4 million).

"It has been an exceptionally successful fiscal year. In addition to our record result, I am particularly pleased that we managed to attract and win many new customers. This shows that it was right to focus on the interest rate reversal at an early stage. As a pioneer, we made classic savings attractive again, but were also able to score points with our customers in other products," says Nick Jue, CEO of ING in Germany.

Nurten Erdogan, designated CFO, adds: "The foundation of our success is our business model with simple, digital banking for private, business and corporate customers. With our popular product range, we have again been able to grow in all business areas. The significant increase in our profit is especially linked to our strong interest result, our consistent cost discipline and our distinctly reduced risk provisions."

Strong increase in customer deposits and number of current accounts

Total customer deposits on savings products and current accounts increased by six percent to just under EUR 143.6 billion (2022: EUR 135.0 billion). The number of current accounts increased by 279,000. At the end of 2023, the Bank managed 3.4 million current accounts (2022: 3.1 million).

In addition to classic savings products, customers continue to rely on securities savings plans

The number of securities accounts increased by 191,000 to 2.5 million (2022: 2.3 million). At 35.0 million, the number of securities transactions carried out for customers was at the same level as in the previous year (2022: 34.8 million). The volume of securities accounts at the end of the year was EUR 88.6 billion (2022: EUR 72.8 billion), an increase of 22 percent.

The number of securities savings plans increased again. At the end of 2023, customers had a total of 1.8 million securities savings plans (2022: 1.6 million). Especially savings plans on ETFs are still in high demand. In January 2024, the bank increased the number of fee-free ETF savings plans from 800 to 1,100.

Volume of consumer credit financing and mortgages increases slightly

The volume of consumer credit rose slightly by two percent to EUR 10.0 billion (2022: EUR 9.7 billion).

The mortgage business was hit by a significant decline in market demand. New business in 2023 was at almost EUR 7.00 billion significantly lower than in the previous year (EUR 13.1 billion). On the other hand, the total volume grew by two percent to EUR 92.7 billion (2022: EUR 91.3 billion).

In 2023 the brokered volume of Interhyp AG, Germany’s largest broker of mortgage financing, declined to EUR 17.2 billion due to market conditions (2022: EUR 29.0 billion).

Business Banking with a steady growth and new call deposit account

Business Banking, the area for small and medium-sized enterprises as well as self-employed customers, once again achieved growth. The total volume for loans increased to EUR 384 million in 2023 (2022: EUR 286 million). At the end of 2023 an interest-bearing call deposit account for SME customers, the "Business Extra-Konto", was launched.

Wholesale Banking with positive results - Germany business further expanded

In the Wholesale Banking business, ING Germany recorded pre-tax earnings of EUR 453 million in 2023 (2022: EUR 37 million).

Revenues from business with German customers both national and international increased. Interest income rose to EUR 513 million (2022: EUR 468 million), while income on commission almost remained unchanged with EUR 60 million (2022: EUR 61 million).

The total loan volume grew by four percent to EUR 30.6 billion in 2023 compared to the previous year (2022: EUR 29.3 billion).

Interest earnings, cost discipline and lower risk provisions are positive drivers of record result

ING Germany improved its interest income to EUR 3.7 billion (2022: EUR 2.3 billion).

The income on commission declined to EUR 414 million (2022: EUR 496 million). This was particularly due to the market driven decreased brokered volume of mortgages.

Expenses for personnel and administration increased moderately compared to the previous year. Personnel expenses amounted to EUR 730 million, therefore seven percent more than in the previous year (2022: EUR 685 million). This was mainly due to salary adjustments. Other administrative expenses amounted to EUR 716 million (2022: EUR 656 million).

The bank was able to largely release risk provision for Russia-related engagements, which were created in the previous year. Consequently, risk provisions decreased to EUR 36 million in 2023 and were therefore significantly lower than in the previous year (2022: EUR 460 million).

Before tax, ING Germany achieved earnings of EUR 2.47 billion in the fiscal year 2023 (2022: EUR 1.04 billion). The cost-income ratio improved by almost eleven percentage points to 36.6 percent (2022: 47.2 percent).

Continued growth across all business areas

"The year 2023 shows that we can rely on many products for customer growth and convince more and more customers to become primary customers," says Nick Jue. "In 2024, we also aim to build on last year's growth in Wholesale Banking. And we are on our best way to develop our Business Banking into a viable third pillar. In doing so, we will continue to focus on our success factors – digital, efficient, customer-orientated."

ING in Germany

With over 9 million customers, we are the third-largest bank in Germany. Our core products are current accounts, mortgages, savings, consumer loans and securities. In the Business Banking segment, we grant loans to small and medium-sized enterprises and offer an interest-bearing call money account. In Wholesale Banking, we offer banking services to large, international companies. With over 6,000 colleagues, we are represented in Frankfurt am Main (headquarters), Berlin, Hanover and Nuremberg.

Disclaimer: All information provided here about ING Deutschland is based on the preliminary IFRS consolidated financial statements of ING Holding Deutschland GmbH, based in Frankfurt am Main, which are still to be tested. Values in tables are rounded. The totals and changes compared to the comparison period in the tables are based on the exact values and may therefore differ if necessary. The discrepancies with the data published by ING Groep N.V. for Region Germany result mainly from ING Group internal group accounting. The forecasts or expectations included in this publication may be subject to uncertainty. The report shall reflect the situation at the time of publication. Forward-looking statements only refer to the date on which they are made. We have no obligation to update such statements in the light of new information or future events.