Global sustainable finance market: changing for the better

20 August 2024

Reading time: 4 min

The global sustainable finance market continues to see decent levels of issuance and new areas of growth in 2024. Green bonds are experiencing strong momentum while KPI-linked debt has embraced innovation and quality improvement. Europe still dominates the market. Meanwhile, elections around the world add to the risk of policy disruption.

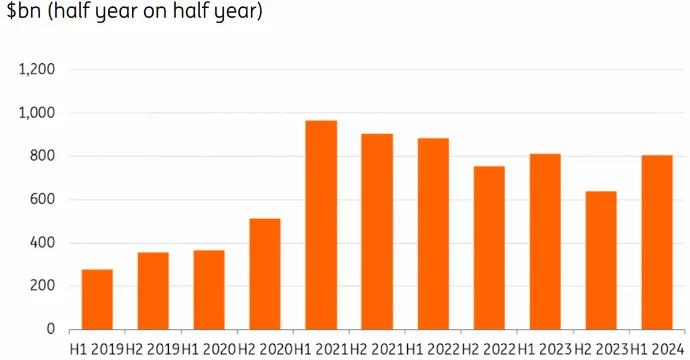

Global issuance in 2024 could match 2023 levels

In the first half of 2024, issuance of sustainable debt around the world reached $800bn, almost at the same level as that in the first half of 2023. This shows that the global sustainable finance market has so far this year been able to maintain the momentum seen in 2023. Issuance in the second half of 2023 was at $640bn, the lowest half since 2021. This year, any improvement from that level would result in an increase in the annual volume in 2024, which is now probable.

Global issuance per half year

Global issuance per financial instrument and year

Data is until 30 June 2024. Source: Bloomberg New Energy Finance, ING Research

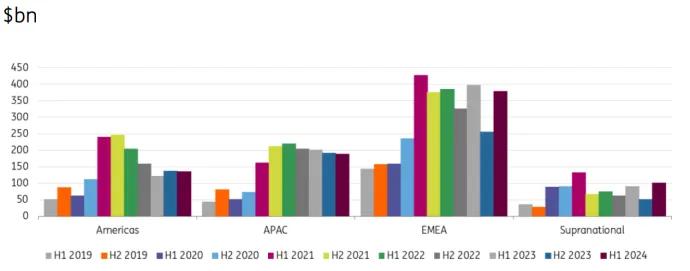

EMEA still dominates sustainable debt issuance

EMEA, led by Europe, remains the largest region in terms of sustainable finance issuance with a strong rebound in volumes in the first half of 2024. The EU’s more comprehensive and advanced ESG regulation ecosystem helps. It is true that recently, the perceived cost of energy transition, and rising populism have led to a stronger right-wing presence in the European Parliament. However, we don’t expect the EU’s green agenda to change fundamentally.

Sustainable finance issuance by region

Data is until 30 June 2024. Source: Bloomberg New Energy Finance, ING Research

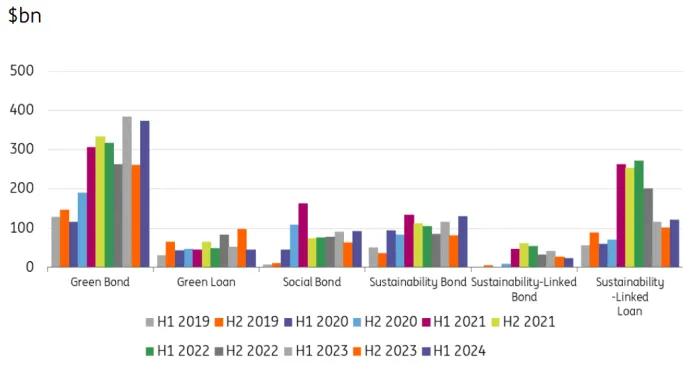

Green bonds hold strong while JPI-linked debt emraces quality improvement

Breaking down issuance by product, we can see that in the first half of 2024, green bonds contributed the most to the global total, and the issuance volume was the second-highest for any half-year period. Besides, green bonds experienced a jump in issuance volume in the first half of 2024 compared to the second half of 2023. Government agencies, sovereigns, municipal, and supranationals accounted for the largest share of green bond issuance in the first six months of 2024, at 42%, but the share of corporates increased from 25% in 2023 to 32% in the first half of 2024, while the share of issuance from financials decreased from 30% to 22% over the same period.

Global sustainable finance product issuance trends

Data is until 30 June 2024. Source: Bloomberg New Energy Finance, ING Research

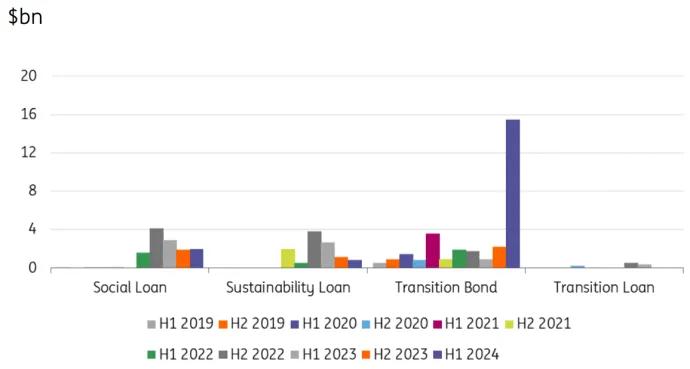

Global sustainable finance product issuance trends (cont'd)

Data is until 30 June 2024. Source: Bloomberg New Energy Finance, ING Research

Another visible trend is the increasing popularity of transition bonds, whose issuance was up almost eightfold in the first half of 2024 compared to the second half of 2023. Transition bonds allow companies to finance decarbonisation activities that are not ‘traditionally green’ but can substantially reduce emissions in hard-to-abate sectors. What could be helpful to this trend is the ICMA's newly published Green Enabling Projects Guidance, which defines activities that are crucial to developing a green project but do not themselves have a direct positive impact on the environment. It is worth noting that Japan dominates the market for transition bonds, largely enabled by the country’s Climate Transition Bond Framework.

Meanwhile, the sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) market is going through constructive changes to improve quality. Sustainability-linked debt allows companies that may not be able to easily identify eligible projects to tap into sustainable finance. Taking a KPI-based approach also allows issuers to tackle sustainability from a broader company level.

Is there still a greenium?

ESG (Environmental, Social, and Governance) issuance has the unique ability to trade at a premium compared to regular bonds. Green bonds are just as likely to be repaid as vanilla bonds, there is no greater or lesser default risk attached to them. So, if green bonds command a premium, it must reflect a prevalence of demand over supply. This is known as the "greenium" and reflects lower yields attached to green bonds compared to vanilla bonds. If there is a greenium, issuance in ESG bonds is cheaper for the issuer and the buyer accepts a lower running yield. This is because embracing ESG is seen as a sensible long-term investment practice and reduces existential risk. However, supply and demand have waned in recent years, and greeniums tend to be smaller. This does not always generate a greenium, but can push in that direction, especially where issuance circumstances are auspicious.Curious to find out more? Read further on this analysis on Opens in a new tabING THINK.

Authors

Coco Zhang

ESG Research

Coco Zhang

Padhraic Garvey

Regional Head of Research, Americas

Padhraic Garvey