Sustainable investments

At ING, we believe that companies addressing climate change and resource scarcity will be the leaders of the future economy. Our strategy is to support you while you transition to a more sustainable business model. ING Sustainable Investments is a dedicated team within ING Corporate Investments with extensive experience in financial structuring and a drive to understand your technology or innovative concept. This enables us to step in when standard financing solutions may not be feasible. Circular economy, energy transition and water management are the focus areas in which we build ample expertise to help you grow or transition your business.

Key elements of our approach include:

- Flexible - whether in terms of products offered, type of business, or governance, flexibility is the hallmark of our approach, enabling us to step in when standard financing solutions may not be feasible. As a subsidiary of ING, we can also facilitate other relevant financing products to provide a fully integrated financial solution.

- Partner - we are a sounding board for management and assist you in unlocking the value potential of your company. We are backed by a global financial institution which is financially strong and we can provide access to our broad ING network.

- Streamlined - the combination of our strong drive to understand your business and extensive experience ensures a streamlined and pragmatic investment process and subsequently allows us to quickly execute the approval and documentation of deals.

Customised solution

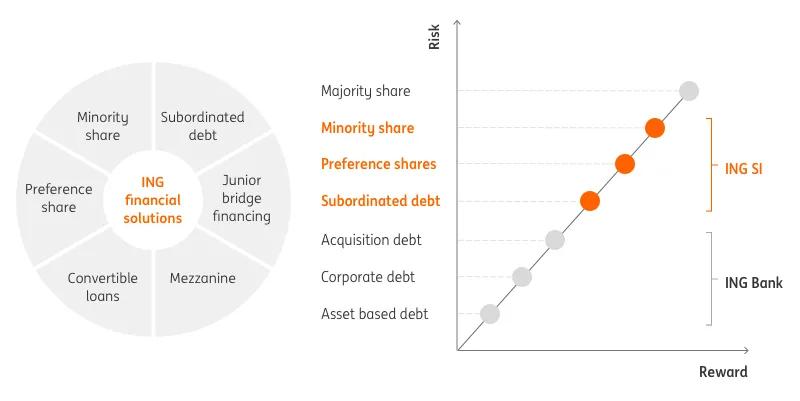

Some innovative technologies, business models or client propositions have a risk profile that is not yet suitable for an all-in senior financing solution. Frequently the underlying technology, innovative concept or life cycle is complex and requires some form of risk capital. This is where ING Sustainable Investments can help you achieve your sustainability goals by offering a wide a range of tailor-made financial solutions, including equity and subordinated debt.

Criteria

To ensure the positive impact of our solutions, investment opportunities are assessed by the criteria set out below. Please do not hesitate to contact us even if your business does not tick all the boxes as we still may want to assess whether your business is a viable sustainable opportunity.

| Business | Financial |

|---|---|

| Measurable sustainable impact | Attractive underlying market fundamentals |

| Focus on scale-ups with a proven concept or pilot plant | Cash flow positive (post-investment) |

| Distinguishing technology or business model with value potential | Funding predominantly used for CAPEX/expansion |

| Motivated, capable and aligned management team | Sweet-spot for equity investments between €2 to 5 million |

| Clear strategy and focus | Sweet-spot for ‘yielding’ instruments between €2.5 to 10 million |

| Limited (operational) involvement, so no loss of control | No fixed investment horizon, predetermined exit structure |

| Open to co-invest with strategic partners |

Need more information?

Mark Weustink - Head of Sustainable Investments