ING Sustainable Finance Pulse - issue 3

31 July 2024

Reading time: 0 min

Welcome to ING’s Sustainable Finance Pulse 3, a quarterly glimpse into the world of sustainable finance and ING’s take on it.

Sustainable finance market update

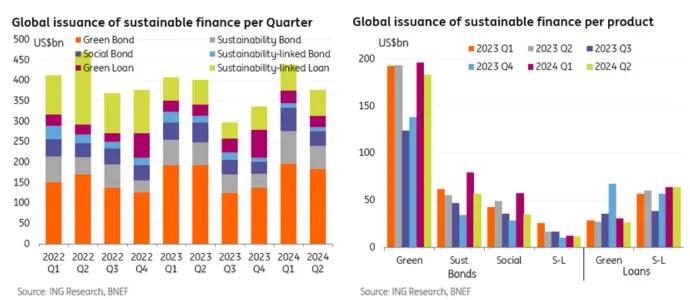

Sustainable finance issuance was slightly slower in Q2 this year, despite a rather active Q1. Global sustainable issuance totalled US$376bn in Q2 2024, which is lower than the average of a little over US$400bn seen in Q2 in the past few years. However, looking at global H1 issuance, pencilled in at US$815bn, this is in line with half year levels of the past few years.

In addition, issuance in the months of July and August have totalled US$200bn, a decent amount for the summer months with primary markets generally closed. However, September is generally a heavy month for supply, thus we should see more coming to the market. In previous years, Q3 levels reached between US$350bn and US$400bn.

In Q2, global issuance was driven mostly by US$183bn green bond supply. This is mostly in line with previous second quarters. Sustainable bond issuance reached US$57bn, on par with the average for Q2. Green loans also come in at average levels at US$26bn.

Meanwhile, Sustainability linked bonds were below average at just US$11bn. At US$35bn, social bonds were below that of Q2 last year and sustainability linked loans at US$64bn was below that of Q2 in 2022. A similar trend looks to be forming in the initial months of Q3 for the various sustainable finance products, however September will be the largest portion of supply in Q3.

In the first half of 2024, global corporate green bond issuance was very strong with a very significant US$120bn total, double that of the previous half year averages. This increase was seen in USD and even more so in EUR issuance.

Global corporate sustainability linked bonds continue to be on the low side at just US$22bn, a continuation of low supply seen in 2H23. This trend is mostly seen in EUR.

On the financials side, global sustainability bonds have revived in 1H, pencilling in US$20bn, double that of the previous few half year totals. This was driven by USD financials sustainability bonds as EUR supply remains consistently low.In the first six months of the year global government bond supply has been substantial. Global green, sustainability and social government bonds have increased issuance at US$178bn, US$108bn and US$78bn respectively.

ESG issuance thus far this year was much more concentrated in the first quarter. For the remainder of the year, we may see more of a continued trend of slightly slower supply. There is more limited windows of opportunity for issuance in the coming months due to US elections, central bank meetings and economic data releases.

Deal highlight

In 2024, ING acted as bookrunner/underwriter, agent, lending and hedging bank, together with other financial institutions, in granting Sosteneo Infrastructure Partners more than €900 million for the acquisition of 49% of the share capital of Enel Libya Flexsys. This company was set up by Enel Group to build and manage a major portfolio of assets related to energy transition: 23 battery energy storage projects for capacity of 1.7GW and three projects for the refurbishment of open combined-cycle gasfired power plants, for a capacity of 0.9GW.

This represents critical new infrastructure, that will provide flexibility and reliability to the Italian grid that is vital for the integration of more renewable generation. Revenues are fully contracted for 15 years through capacity agreements with Enel as well as capacity payments from Enel that are backed by Terna SpA, Italy’s transmission system operator

Want to know more about ING’s renewables team? Contact Opens in a new tabDiederik.van.den.Berg@ing.com.

ING continues to deliver strong growth in 2Q24

Despite slightly lower activity in the market in general, ING continued to deliver strong growth in 2Q24. In terms of volume mobilized 2Q24 turned out to be even stronger than 1Q24. The volume achieved amounted to € 32.2bn. An increase of ca 30% compared to 1Q24 and compared to the same period last year. We closed in total 204 sustainability transactions.

Like the market in general, the EMEA region still represents the bulk of ING’s sustainable finance activities, continuing to contribute ca 70% of volume mobilized. The deal pipeline of our APAC sustainable franchise remains healthy, performing consistently with the robust growth of the market in general. Despite the volatilities and uncertainties in the Americas market, ING managed to grow its volume compared to the volume in the same period last year. Volume mobilized in Americas was primarily geared to engagement on Green Loans and Sustainability Linked Loans, showing moderate activity in the public debt market.

Where market participants are concerned that increased regulatory scrutiny could negatively impact the volumes of Sustainability Linked Loans, to date this is not showing up as a trend in ING’s YTD24 volume mobilized realised.

Jacomijn Vels, global head sustainable finance at ING: “The first half of 2024 for ING has been the strongest start of the year since we introduced our volume mobilized target. Contrary to 1Q24 where public debt markets represented the largest share, in 2Q24 the sustainable lending markets were the drivers for growth of our volume mobilized. Showing healthy volumes for both Sustainability Linked Loans and Green Loan volume. With more subdued markets, it remains challenging to predict what 2H24 will bring. With strong deal pipeline across all three regions, we remain optimistic of being able to achieve the full year aim of EUR 120bn.”

Producing plastics without fossil fuels – at what cost?

The plastics industry is adopting technologies for reducing fossil fuel use, but not without a cost. Currently it is economic reality that oil and gas-based plastics are the cheapest options. But instead of looking at ways to mitigate the CO2 impact of plastics derived from oil and gas, as we've explored in detail Opens in a new tabhere, this ING research article provides insights into the business case of hydrogen-based plastics, bio-based plastics and recycled plastic – all of which provide an opportunity to move away from fossil fuels.

These methods however come with significant costs, a major drawback in an industry that is heavily cost-competitive. A shift in the plastic production paradigm is therefore required, especially when the economic viability of greener plastics is not yet competitive enough to self-sustain.

Putting muscle behind renewable energy’s push into 2030

The International Energy Agency said last year that Opens in a new taba tripling of renewable energy capacity by 2030 will be needed to put the world’s climate on a 1.5C trajectory.

At ING, we want to play a leading role in accelerating the transition to a low-carbon economy. We see a powerful business case in financing the scale up in renewables investment called for by the IEA. We are gearing up, and staffing up, for a surge in our own target for power generation lending to, for example, wind, solar and batteries to 7.5 billion euros a year by 2025 (three times the 2.5 billion euros target announced in 2022).

Opens in a new tabIn a special article, ING’s Michiel de Haan looks at the prospects for rapid growth of renewable energy in the years ahead, and at the specific opportunities afforded by technologies such as solar, wind and batteries in markets such as the US, Europe and Australia.

ING & Climate

Society is transitioning to a low-carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. See how we’re progressing on Opens in a new tabour climate approach.

Authors

Peter Kindt

Global Sector Sustainability Lead

Michiel de Haan

Global Head Energy sector

Gerben Hieminga

Sector Economist, Energy

Timothy Rahill

Credit Strategist

Astrid Overeem

Global PR Manager Wholesale Banking

Diederik van den Berg

Global Head Renewables sector

Sustainable finance issuance certainly saw some growth in 2024. Looking forward, our global head of Sustainable Solutions Group, Jacomijn Vels, says that there’s reason for both optimism and caution for 2025: “The beginning of this new year shows signs that the sustainable finance market is off to another positive start.”

ING Sustainable Finance Pulse - issue 5

ING Sustainable Finance Pulse - issue 5

We saw the increase in volume mobilised driven by sustainability-linked loans and green bonds. In addition to volumes from loans and bonds, we’ve also seen greater sustainable finance volumes in 2024 relating to commercial paper and guarantees, demonstrating our engagement with clients across a wider range of sustainable finance products.

ING Sustainable Finance Pulse - issue 4

ING Sustainable Finance Pulse - issue 4